How to trade a Relative Vigor Index

How to trade a Relative Vigor Index

It's based on the principle that in a rising market, we expect the closing price to be on balance and in general, higher than the opening price. Similarly, in a falling market, we expect the closing price to be, more often than not, lower than the opening price.

There are hundreds of technical indicators that are found in most trading platforms like the MT4, PPro8, and TradingView. A sell signal is generated when the RVI indicator is abovethe zero level and is heading down after the crossover of RVI indicator. A buy signal is generated when the RVI indicator is below the zero level and is heading up after the crossover of RVI indicator. However, in this post, you will learn about how to trade the RVI indicator.

The relative vigor index (RVI or RVGI) is a technical indicator, which anticipates changes in market trends. Many day traders consider the RVI a "first cousin" of the Stochastic Oscillator due to the similarities in their formulas (both use the open, close, high and low of each candlestick). The Relative Vigor Index (RVI) is a technical analysis indicator that measures the strength of a trend by comparing a security's closing price to its trading range and smoothing the results. It's based on the tendency for prices to close higher than they open in uptrends and to close lower than they open in downtrends.

In the first example, in a downtrend, you can see how price posts a fresh low, but the RVI has signaled a higher low in this case (anticipating a change of direction in price). When you already determine the trend in the price, you can look to go long or short based on the trend during the bullish or bearish crossovers respectively. Yes, there is and this is in the form of the falling wedge, which is a bullish reversal signal.

The English version of all our communications and the content of this is the official version among the authorized parties and is the only version that prevails for legal purposes. If the market is flat, look for the RVI to exit the overbought (high) or oversold (low) areas for a signal to sell/buy.

Overbought levels are used to signal opportunities to short or sell while oversold levels are used to signal opportunities to buy. Technical analysis is the process of using tools that have been developed using mathematical calculations to forecast the direction of an asset.

Stable results are given by strategies using classical trend instruments, where RVI acts as the main oscillator. When the indicator is flat − the mutual movement of lines in horizontal direction − does not count as a trading signal.

The Relative Vigor Index is a technical indicator that measures the likelihood of the recent price action. The RVI, although looking similar to the Stochastics or other oscillators merely anticipates changes in the market trend.

John applies a mix of fundamental and technical analysis and has a special interest in inter-market analysis and global politics. The RVI Divergence and TrendsIn the above example, you can see the RVI divergence at work.

After getting the strong bullish candle place a buy entry and ride the trend. The main advantage of using the RVI indicator is the fact that it is the leading indicator. RVI indicator is a program founded on the mathematical formulas and economic data of the various sources, which helps the traders to choose the trades. The red line is a “trigger line.” It is a 4-period volume-weighted moving average, and it provides trade signals when it crosses above or below the standard moving average green line. The author of Relative Vigor Index believes that the fast line analyzes the pace and equilibrium of the market for periods of less than one hour, the long one − from H1 to W1.

- The chart above shows the RSI smoothing and signal lines crossing at two negative areas.

- The Relative Vigor Index (RVI) Forex Trading Strategy is based on a lesser know forex indicator called the Relative Vigor Index or the RVI.

- These setups must ideally be practiced and left for the trader to decide.

- MetaTrader 4 plots the signal line in red on the same chart as the main RVI line.

The Relative Vigor Index forex trading strategy is a trend following strategy with complete entry and exit trading rules. While this can be achieved using other trend indicators such as moving averages, the RVI is particularly useful when it comes to trading with divergence. Founded in 2013, Trading Pedia aims at providing its readers accurate and actual financial news coverage.

The Stochastic Oscillator uses price in comparison to the low of the day. In contrast, the RVI uses price in comparison to the high of the day, as we have seen. Many versions of the RVI indicator, in fact, perform a double smoothing. This first applies a symmetrically-weighted finite impulse response (FIR) filter, and this is then averaged over 'N' periods. The precise mechanism of this isn't particularly instructive, so we will refrain from going deeply into it.

The green line is a standard moving average of the RVI indicator. The default value of the green line is 10 – periods, but traders used it in multiple ways to maximize their profits. Most of the traders change the default value to some of the common 7,9,14 periods, which gives them the smooth ride in the market. However, the Vigor Index compares close levels relative to opening levels, and not the minimal price as is done by Stochastic.

Make Money by Opening a Trading Office

The Relative Vigor Index (RVI) measures the strength of a trend by comparing an asset’s closing price to its trading range and smoothing the results. The key factor of the RVI indicator is that prices tend to close higher than the opening price in an upward trend and close lower than the opening price in a downward trend. Higher values for the RVI point out booming the strength of the trend, while lower value indicates a weakening of strength.

Technical analysis focuses on market action — specifically, volume and price. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. Divergence between the RVI and the price action may signal a change in trend. Trend trading is a style of trading that attempts to capture gains when the price of an asset is moving in a sustained direction called a trend. Polarized Fractal Efficiency is a technical indicator used to determine price efficiency over a user-defined period.

Confirmation of an impending retracement is sought by using another technical indicator, the relative strength index(RSI). If the RSI indicates overbought conditions in the market by readings above 70, this is taken as a confirming signal of the RVI divergence indication.

This trade example displayed above shows a trend reversal trade. The Relative Vigor Index lines can be seen crossing at a heavily negative area, which is considered as the oversold area. Confirmation of trend reversal is seen with the appearance of a candlestick reversal pattern (the hammers) at the bottom of the chart following a period of down-trending prices.

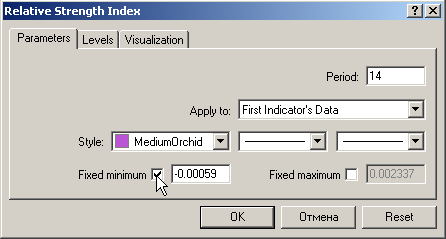

The Relative Vigor Index indicator is calculated as the actual price change for a certain period divided by the maximum range of price changes in that period. To reduce the dependence on strong price fluctuations, the averaging was applied according to the algorithm of Simple Moving Average with the period of 10. Relative Vigor Index, developed by John Ehlers, is a technical indicator designed to determine price trend direction.

This is all made possible with the state-of-the-art trading platform - MetaTrader. Admiral Markets offers MetaTrader 4 and MetaTrader 5 with an enhanced version of the platform known as MetaTrader Supreme Edition.

Therefore, we go long the moment the green line of the relative vigor index tool breaks the red line signaling a new bullish trend. After we go long, we get a price increase of 50 cents, which equals about 4% of the total price per share. Now, if you are concerned that the calculations above seem a little too involved, don't worry.

Комментарии

Отправить комментарий