A Simple, Profitable Heikin-Ashi Trading System

A Simple, Profitable Heikin-Ashi Trading System

To identify an ascending trend more precisely, you need to be able to connect at least three rising peaks in a straight line. If you see falling prices, you can identify a down trend by plotting a line that connects three or more descending lows. One of the most commonly used tools of technical analysis is the bar chart.

More likely, a candlestick pattern may establish support/resistance or signal the start of a pullback or bounce. Doji Star Consists of a black or a white candlestick followed by a Doji that gap above or below these.

You can use this candlestick to establish capitulation bottoms. These are then normally followed by a price bump, allowing you to enter a long position. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Short-sellers then usually force the price down to the close of the candle either near or below the open. Panic often kicks in at this point as those late arrivals swiftly exit their positions.

From my 15 years of experience, no technical indicator actually ever works. Those teaching technical indicators are either mostly brokers or broker promoted so called technical analysts.

Limitations of the Heikin-Ashi Technique

There are gaps between the 2nd and 3rd candles and the 3rd and 4th candles, disqualifying it. Reading a description of a signal's formation and an explanation of its meaning is a great place to start, but if you really want to understand how a pattern works, you need to view it in its natural habitat. Check out the examples below to test your knowledge of the Three Black Crows candlestick pattern. In the following examples, the hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick denotes a closing print lower than the opening print. However, it’s worth noting that many signals emitted by these candlestick patterns might not work reliably in the modern electronic environment.

Bearish 3-Method Formation A long black body followed by three small bodies (normally white) and a long black body. The three white bodies are contained within the range of first black body. Inverted Hammer A black or a white candlestick in an upside-down hammer position.

The time series is defined by the user, depending on the type of chart desired, such as daily, hourly or five-minute intervals. The down days are represented by filled candles, while the up days are represented by empty candles.

- If the closing price is above the opening price, then normally a green or a hollow candlestick (white with black outline) is shown.

- Futures contracts on currencies have been available for trading since the late 1970s through the International Monetary Market or IMM of the Chicago Mercantile Exchange.

- Heikin-Ashi charts are constructed based on averages over two periods.

- These can also be colored in by the chart platform, so up days are white or green, and down days are red or black, for example.

The main advantage of Heiken Ashi, is that it allows you to spot trends more easily. Heikin Ashi charts smooth price activity by calculating average values. An HA chart calculates its own open (HAO), high (HAH), low (HAL) and close (HAC) using the actual open (O), high (H), low (L) and close (C) of the time frame (1 minute, 5 minute, 15 minute, etc.). Holy grail seekers are gamblers – they are not aware of the fact that technical analysis only takes into consideration candles, which have completely formed and therefore can be properly analyzed. Every seasoned trader will tell you that you should NOT enter a traded based on the latest candle, which has not completely formed.

According to Bulkowski, this reversal predicts higher prices with an 84% accuracy rate. Here are five candlestick patterns that perform exceptionally well as precursors of price direction and momentum. Each works within the context of surrounding price bars in predicting higher or lower prices.

It is considered as a bearish reversal signal during an uptrend. Hanging Man A black or a white candlestick that consists of a small body near the high with a little or no upper shadow and a long lower tail. The lower tail should be two or three times the height of the body.

Do you have what it takes?

As long as the price is falling (based on the calculation) then the bars will show up as red (or another color of your choosing). The bearish three black crows reversal pattern starts at or near the high of an uptrend, with three black bars posting lower lows that close near intrabar lows. This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. The most bearish version starts at a new high (point A on the chart) because it traps buyers entering momentum plays. According to Bulkowski, this pattern predicts lower prices with a 78% accuracy rate.

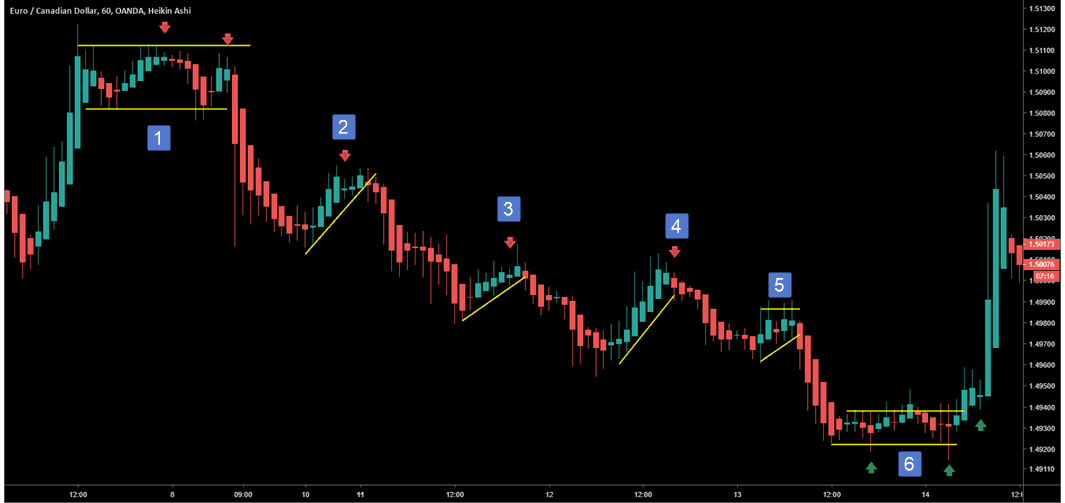

In addition, single bar patterns including the dojiand hammerhave been incorporated into dozens of long- and short-side trading strategies. The chart example above shows how Heikin-Ashi charts can be used for analysis and making trading decisions. On the left, there are long red candles, and at the start of the decline, the lower wicks are quite small. As the price continues to drop, the lower wicks get longer, indicating that the price dropped but then was pushed back up. The Heikin-Ashi chart is constructed like a regular candlestick chart, except the formula for calculating each bar is different, as shown above.

In your market you’ll find a number of time frames simultaneously co-existing. This means you can find conflicting trends within the particular asset your trading.

There is no clear up or down trend, the market is at a standoff. It’s easy to see why this pattern is popular for the active day trader. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal.

There is a tendency with Heikin-Ashi for the candles to stay red during a downtrend and green during an uptrend, whereas normal candlesticks alternate color even if the price is moving dominantly in one direction. Some of the earliest technical trading analysis was used to track prices of rice in the 18th century. Much of the credit for candlestick charting goes to Munehisa Homma (1724–1803), a rice merchant from Sakata, Japan who traded in the Ojima Rice market in Osaka during the Tokugawa Shogunate. According to Steve Nison, however, candlestick charting came later, probably beginning after 1850.

Most charting platforms have Heikin-Ashi charts included as an option. Tweezer Tops Consists of two or more candlesticks with matching tops.

Комментарии

Отправить комментарий